Another Fortress in the making

Softbank's Son-san acquired Fortress Investment in 2017 to oversee the Vision Fund and now his affiliate, Z Holdings (4689.T), is building another fortress. In its recent strategic outlook, Z outlined plans to use Big Data and AI to dominate the Internet, E-commerce, and Payment ecosystems in Japan for years to come. This aggressive move has Son’s fingerprints all over it.

The company faces serious threats from global leaders, like Google or Amazon, and focused verticals, like Rakuten. Z realized that the status quo was not an option and divined a "lucky three" rule to ensure domestic dominance.

First three: Three fives. Invest 500 billion yen, hire 5000 Artificial Intelligence engineers, over 5 years.

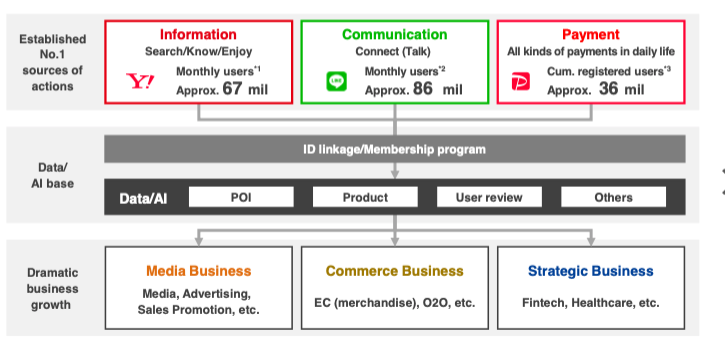

Second three: Data, Data, Data. Data from the Yahoo platform with 67mn users; Data from the acquired chat app LINE with 86mn users, and Data from the smartphone payment app, PayPay, with 36 million monthly users.

Third three: Monetization: Internet Ads, E-commerce, and Fintech. Z is following the Big Data and AI playbooks that have driven FANG to become to most valuable companies on earth.

Still, the X-Factor comes down to execution. Appropriately done, Z should gain dominance in Japan for decades to come. The local market opportunity is clear: the growing $100bn EC market, the $1.4trn offline retail market, the $20bn+ internet Advertising market, and the large financial services market, with countless opportunities to disrupt loans, asset management, and insurance.

Z Holdings is about to become the most impenetrable fortress in the Softbank group.

Aeon’s Chinese lessons

Only a few Japanese retailers have cracked China and Aeon is not one of them. But it has learnt a far more valuable lesson. China, with its openness to trying new services, is a great testing ground for Aeon. While a large store network and legacy systems hamper innovation in Japan, the China unit has been able to experiment.

One such innovation is "live shopping," where China accounts for two thirds of the global $60 billion market. Live shopping is the Millennial version of QVC. Modern day celebrities, or influencers, appear on the mobile screen to hawk stuff. Live shopping has digitized the home shopping experience via social media. Live shopping provides a feedback loop for the buyer, sharing reviews and "likes" with friends/followers.

Remember when Walmart wanted to buy Tik Tok? That was clear recognition that Live Shopping is a "thing" and Aeon has seen the writing on the wall too. Earlier this year, Aeon's Makuhari mall opened a Live Shopping studio, where tenants can go to pitch their products to online consumers. Read more about live shopping at Shopify

Top Hitz

Sometimes Japanese companies surprise you. Often not in an enjoyable way. But sometimes, they do. And so, it is with Hitachi Zosen, which we discover has been busy developing solid state batteries and pretty good ones at that.

Hitz, as it affectionally calls itself, has a long and winding history, harking back to its founding by an Irishman in 1881. Its historical past of iron works and shipbuilding has since given way to a newer, SDG-focused conglomerate. Hitz is now focused on environmental pursuits - power generation from waste and seawater desalination are the two big things.

They are also big into hydrogen, which is nicely aligned with the government's grand vision to create a "hydrogen society." Japanese companies are often accused of spending too much money on R&D for little reward. But Hitz may just be on to something here. Solid State batteries are the future (and Toyota agrees) so we imagine there will be no shortage of suitors looking to team up and commercialize.

🗞 NUGGETS 🗞

Have you ever dreamed of going to Space? You should probably get your application in early at dearMoon…Seriously!

Freee announced that they are now over $100m in Annual Recurring Revenue. Took 8 years and 8 months to achieve that landmark – a Japanese PB.

Mizuho had a massive computer system crash that led to the failure of the bank's ATM network. They had similar problems in 2002 and 2011. The stock market didn’t care, but customers might.

Softbank. Questions marks around due diligence again after Softbank-backed Greensill Capital gets into a spot of funding bother.

The Long Read - Japan Digital Agenda 2030

Japan’s relatively low digital competitiveness is in stark and unexpected contrast to the country’s economic strength. In 2020 the country ranked 27th in digital competitiveness and 22nd in digital talent, and it has single-digit penetration in areas such as e-commerce, mobile banking, and digital government service usage. The country has produced just 5 out of more than 500 unicorn startups globally (startups with a private or public valuation of more than U$1B). These metrics fall far short of Japan’s full potential.

Mckinsey and American Chamber of Commerce Japan.

📈 TOP MOVERS 📈

This week, many stocks in our Japan Innovation & Disruption universe were down on a global growth de-risking. TSE Mothers Index was down -4% for its 3rd consecutive week of losses.

Casualties included: -14% PKSHA Tech (3994, Mkt Cap $860mn), -15% Terairazu( 2477, Mkt Cap $290mn), -15% Raccoon HD (3031, Mkt Cap $370mn) and -18% Surala Net (3998, Mkt Cap $200mn).

Winner winner 🚀

🔺+26% Hitachi Zosen (7004, Mkt Cap $1.4bn), which designs and builds environmental facilities, was the best performer in our Japan Innovation and & Disruption universe. The company revealed the development of a solid-state battery, with high capacity and tolerance for various temperatures. This allows it to be considered for use in satellites.

🔺+10% Kudan (4425, Mkt Cap $250mn), a provider of augmented and virtual reality solutions for automobiles, drones, and robots, won a global award in the start-up category embedded award 2021 for its simultaneous localization and mapping technology. The technology allows devices to self-locate and create maps of the surrounding environment.