BrainPad (3655) | Quick Look

Share price ¥6,280 | Market Cap: $420m | EV/Rev: 4.5x

SUMMARY

BrainPad is a leading company in the field of data utilization.

Shortage of digital professionals in Japan drives demand for BrainPad’s services.

BrainPad deploys analysts to client companies - $140b TAM for digital professionals in Japan.

MODEL

BrainPad offers two services: Professional services (69% of LTM sales) and Products (31% of sales)

Professional Services: Data analytics/consultancy. Revenue generated by deploying data analysts, consultants and system integrators to client companies on a project basis.

Product: Sales of various data platforms, visualization tools and RPA. Key proprietary product is Rtoaster – a data utilization platform that automates optimized customer experience and maximizes business value. Integrates a customer data platform, web/app optimization tools, and multi-channel messaging.

Professional Services is key revenue driver (FY6/18-21 +55% revenue CAGR). BrainPad works with approximately 500 companies to better utilize data to improve marketing functions, supply chain management and human resources.

Customer base includes blue chips such as Yahoo Japan, Google, Toyota, JAL

Revenue is dependent on number of analysts deployed multiplied by the amount of time spent on the project.

BrainPad’s strategy is to increase sales per client. The number of clients paying over $1 million pa has increased from seven to eleven over the past two years.

Margins expand with the length of project as less downtime for analysts between jobs and better utilisation rates.

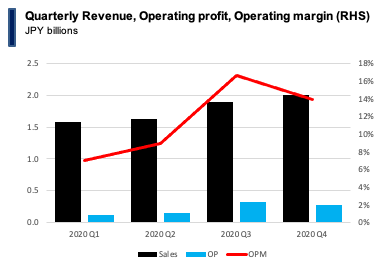

Average OPM ~15%: Client companies hit by COVID-19 led to lower utilization rates and 1H OPM of 8%, but normalizing in 2H.

Key cost is personnel. The company has 427 employees in total including 150 data scientists, 30 consultants and 50 systems integrators. Looking to hire around 100 this year to grow the business at target 20%.

MARKET

Technologies such as cloud infrastructure, data analytics, and machine learning are driving demand for BrainPad’s professional services. BrainPad supports companies that lack skills to embrace Digital Transformation.

There is a lack of digital talent in Japan.

Software/data talent is constrained by current education trends: only 1% of undergraduate students enrolled in computer science-related courses in Japan, compared to 4% in the United States

Some 67% of Japanese respondents cited talent availability as an obstacle to transformation, compared to 38% globally.

According to the Ministry of Economy, Trade and Industry, Japan faced a shortage of 170,000 digital professionals in 2015, a number expected to rise to 430,000 by 2025.

We estimate the TAM for digital professionals (software development, system analysts, data) in Japan is around $140 billion.

MOAT

Switching costs: deployment of data analysts to client companies requires a high level of trust. BrainPad can become embedded within the organization and continue to develop new, higher value-add services.

Barriers to entry: the shortage of software engineers and data analysts in Japan. BrainPad has one of the biggest independent teams that can be deployed across industry verticals. Ability to hire graduates is key. BrainPad is competing with the likes of Accenture, Bay Current, NTT Data and NRI for talent.

MANAGEMENT

BrainPad is a founder-led, experienced and shareholder-aligned management team.

Total nine directors, including five outside directors and one female.

Founder, Kiyonosuke Sato, is ex-NEC Corp, established Brainpad in 2004. Owns 9.7% of outstanding shares (worth ~US$37 million).

Founder, President/CEO Takashi Kusano, is ex-Sun Micro/Oracle. Owns 230k shares

Shareholders: Company has tie-up with ITOCHU CORP, which owns 3% of BrainPad.

Mid-Term plan guides revenue of ¥11.5b in FY6/23 versus LTM ¥7.1b. Stategic plan calls for top line organic growth and M&A to acquire human resources.

Strong Balance Sheet: Cash on hand ¥3.4 billion, zero debt, and shareholders' equity ¥4.7billion. Equity ratio of 81%.

VALUATION

Company targets revenue growth of 20% to ¥8.5 billion in FY6/22

Current market cap of ¥46 billion ($420m)

4.5x FY6/22 EV/Sales

60x FY6/22 P/E

Comps EV / LTM Sales: Bay Current 17x, NRI 4.5x, NTT Data 1.2x

Thank you for reading. If you like the NipponNuggets please feel free to share