⼤ THE BIG IDEA ⼤

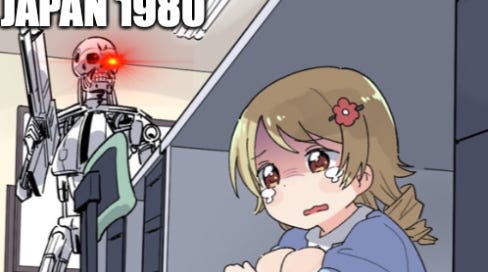

According to a recent study by KPMG, US executives fear AI adoption may be moving too quickly - a destructive force without proper controls. Japan, in contrast, needs to accelerate Digital Transition and AI adoption to mitigate the risk of being completely left behind.

In the 1980s, Japan was set to take over the world with superior technology, advanced management practices, and financial capital. Then the software revolution arrived. Today, Japanese companies have the financial capital but lag elsewhere. A quick survey of the top 100 firms by market cap reveals a telling story. Fifty-eight are from the US, and 16 are from China. The third largest economy only boasts two companies – Toyota and Softbank. That’s it! What is striking is that the US and China's most prominent firms are primarily disruptive, innovative, and digital. Toyota is innovative but not disruptive, while Softbank is a giant venture capital firm that invests in global disruption. Most companies and the overall economy have not kept pace with global digitization.

A study by McKinsey highlights how far behind Japan has fallen behind in digitization. Japan now ranks 27th overall for digital competitiveness (based on knowledge, technology, and future-readiness), down from 23rd in 2015. This contrasts with the first-ranked US, while China leapt from 33rd to 16th. One telling statistic was the measure of Economic Renewal. In Japan, the startup market cap/total market cap was just 1%. That compares to 31% in the US. As a result, Japan was the only country in the top 3 to record negative productivity growth over the past decade.

Japan needs to digitalize and do it quickly or risk further falling behind. The aging society and lack of labor will not help. These invite digital solutions to lift productivity. Moreover, digital companies have captured the lion’s share of economic profits and this trend will likely accelerate, barring intervention.

Covid-19 has been a wake-up call for companies. Spending on digitalization has surged as firms raced to enable staff to work from home and keep doing business. The establishment of a Digital Ministry to revamp government services has sent a strong signal to business leaders. Digitization and AI initiatives are not just nice to have, they are imperative if Japan is to lift productivity and regain its status as a center of innovation. In the end, effective change will likely come from Japan’s younger generation of companies.

🗞 NUGGETS 🗞

How wide is your moat? Insight into how long competitive advantage lasts post IPO for different sectors. Computer hardware and biotechnology don’t do so well, while pharmaceutical and software companies are more resilient. CFA blog

Hit the gas. Full-electric vehicles are expected to account for more than 70 percent of VW’s European vehicle sales by 2030, compared with a previous target of 35 percent, according to the company’s new 'Accelerate' strategy.

Global EV sales surged by 38% YoY in 2020 to 3.2 million units. The cumulative fleet of EVs globally now stands at 11mn units – the same figure for hydrogen fuel cell cars is (🥁) 28,000. Electric Cars Report

But that is not stopping the Japan Auto industry from getting behind green hydrogen. The Chairman of the Association, Toyoda Akio, is backing Hydrogen, which makes sense given Toyota are practically the only car maker in the world that haven’t ditched FCEV in favour of EVs.

Common thread? Coupang’s IPO was the biggest by any Asia-based company in New York since Alibaba Group’s listing in 2014. Softbank invested $1b in the company in 2015 at a valuation of $5b. Koupang’s market cap is now worth $85b, not too far shy of Fast Retailing’s. Bloomberg

If you can't beat them…. With digital disruption happening at breakneck speed, Japan’s older companies are doing their best to keep up, organically (Ricoh) or via acquisition (Panasonic).

The Long Read: Nikkei on Fukushima

The task ahead is huge. Thousands of fuel rods from the first, second, fifth, and sixth reactor units are yet to be taken out, a process expected to take until 2031. But....the most difficult part has not even begun: removing the melted fuel from the innermost core of the reactors. An estimated 900 tons of nuclear debris remain in the three reactors, left from the meltdown

📈 TOP MOVERS 📈

This week, over 80% of the 140 stocks in our Japan Innovation & Disruption universe were up. TSE Mothers Index of growth stocks rose over 3% after being down for 3 consecutive weeks.

🔺+26% Raskul (4384, Mkt Cap $1.2bn), the digital services provider to the printing, logistics, and advertising industries, reported 2Q Sales of ¥7bn, +28% YoY while Operating Profit swung into the black. The company saw an increase in the number of orders per client. Strong growth continues into Feb with monthly sales up 34% YoY.

Other winners included 🔺+21% M-UP (3661, Mkt Cap $240mn) and 🔺+17% Headwaters (4011, Mkt Cap $140mn). Both rose with the reversal in small-cap growth stocks this week.