Kudan (4425) | Quick Look

Share price: ¥3,960 | Market cap: $300m | EV/Rev: 225x

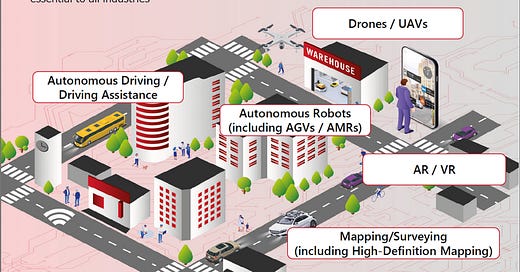

Kudan is a leader in Computer Vision and a developer of Artificial Perception (AP) technology solutions. AP will be the basis for a broad range of industries including autonomous driving, robotics, drones, arial surveillance, and mapping.

What is AP and SLAM?

AP acts as the eyes of machines, allowing them to perceive and understand.

AP complements and operates in unison with artificial intelligence to allow a range of machinery to move and function autonomously.

Although far from commercialisation, the company has been pushing the boundaries of research in computer vision, focusing on Simultaneous Localisation and Mapping (SLAM).

SLAM software allows machines and devices to understand where they are, how they are moving, and the structure of their environment. AP algorithms are able to process information from various sensors to accurately map the external environment and, combined with AI, bring machines closer to interacting with the world as humans do.

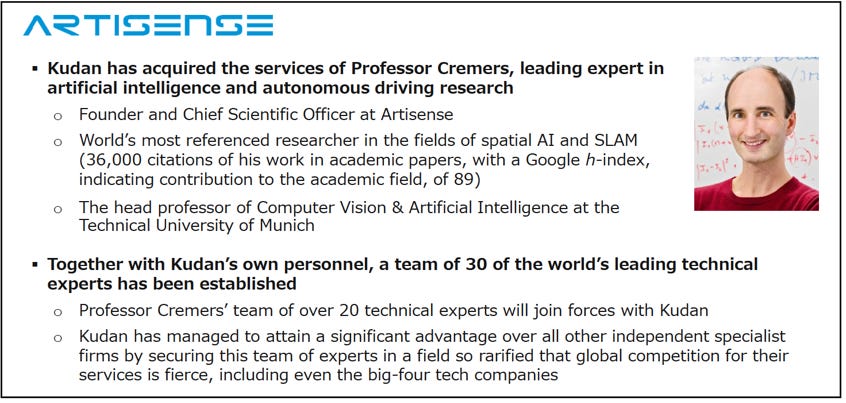

In 2020, Kudan acquired Artisense, a German firm computer vision firm, for EU55m. This purchase secured a 20-strong team of AI engineers, led by Professor Daniel Cremers. Dr. Cremers is a globally recognised and published leader in AI, computer vision, and autonomous driving research.

Technology leadership

With the acquisition of Artisense, Kudan believes it has solidified its leadership in SLAM Technology. SLAM breakthroughs will require merging SLAM technology with Deep Learning, where Kudan is now a major player with 30 AI engineers.

Business model

Kudan is all about long-term opportunities. Current revenues for FY3/21 were just over $1m, with an operating loss of -$4m. However, the long-term market opportunity for the company is considerable.

The business model is conceptually similar to ARM (acquired by NVIDA from Softbank for $40b) or to a biotech company. After the product is commercialised, the bulk of the revenues will come from licensing fees.

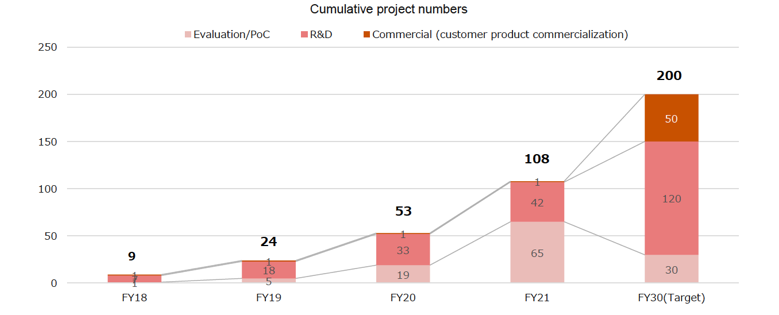

Kudan works with clients on a project basis, with these broken down into evaluation, R&D, and product commercialisation. As a project moves into commercialisation, revenues will come from license fees and successful expansion of the customer product. At present, the company has 108 projects, of which 65 are under evaluation, 42 are in the R&D stage, and one is commercial. By 2030, the company targets 200 projects, of which 50 are expected to be commercial and generating licensing revenue.

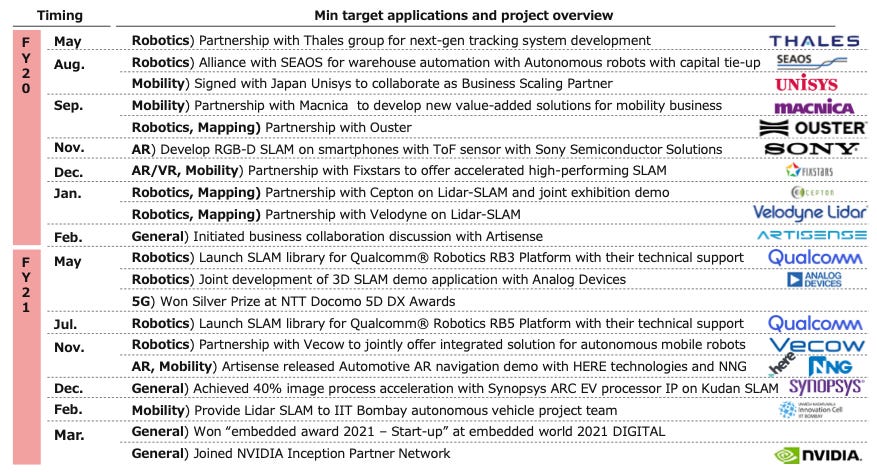

Kudan works with leading companies both within and outside of Japan. The table below shows a list of partners with the potential for future commercial licensing revenue.

Over the next five years, the product launch timeline will span autonomous driving, mobile robots, AR/VR, mapping, and surveying applications.

And then, over the next decade, Kudan will focus on scaling and expanding recurring revenue, from the commercialisation of products using the group’s software.

Management

The founder and current CEO, Tomohiro Ohno, set up the company in 2011. As an alumni of the University of Bristol, the company was founded in the UK, before moving the HQ to Tokyo, ahead of a TSE Mothers listing in 2018. Ohno retains a 49% ownership of the company, with other members of the Kudan team taking management control to over 50%. The company has decided to stay independent as they believe they have genuine technical leadership with excellent commercial prospects.

We do not try to value Kudan at this stage. While there is a significant long-term opportunity, investors should be aware that there will be minimal revenue or profit recognition for the next few years. Like bio-tech investors, the focus will be on R&D, IP and ability to scale the number of clients and projects.

Japan Disruptive Innovation - Winners and Losers

Our Japan Innovation and Disruption universe declined –3.8% fall this week. The more extreme moves are detailed below:

🔺+23% ATRAE (6194, mkt cap $460m), the big data driven HR jobsite rose after it was disclosed that founder and CEO Yoshihide Arai's stake fell to 34% from 36%.

🔺+16% CROWDWORKS (3900, $220m), the provider of crowd sourced matching services for freelance projects rose as it was reported that agents on the platform exceeded 70,000.

🔻-15% AI INSIDE (4488, $520m), the AI firm resumed its downward trajectory. It was reported a few weeks ago that NTT West would not renew its unused license. The stock is down 52% since May 1st.

🔻-18% KAOVNAVI (4435, $350m,) the cloud-based HR talent management software provider fell as Japan retail investors dumped small cap growth stocks.

Check out all the movers here: Google Sheets