The Nippon Nuggets is all about finding Japanese companies that are innovative. Companies that will disrupt the old way of doing business. We are tracking over 140 companies that are at the forefront of Digital Transformation and cutting-edge Innovation. These are small companies (even micro cap) - some may be multi-baggers, but others may fail! You have been warned, so please do your own research if you are thinking of putting any money to work in these crazy markets.

MONEY FORWARD (3994) | Quick Look

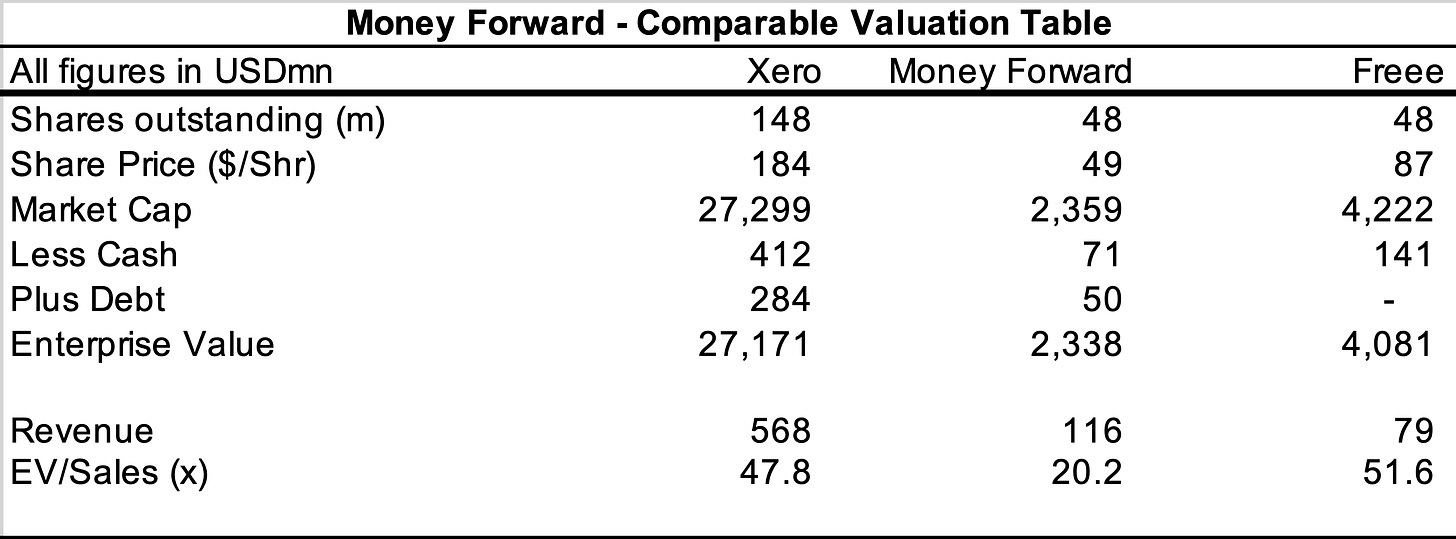

Share price: ¥5,260, Market Cap: $2.4b, EV/REV 20x.

The MODEL

Money Forward (MF) is a leading Japanese fintech company that operates cloud-based SaaS accounting software for businesses and a Personal Finance Management platform (PFM).

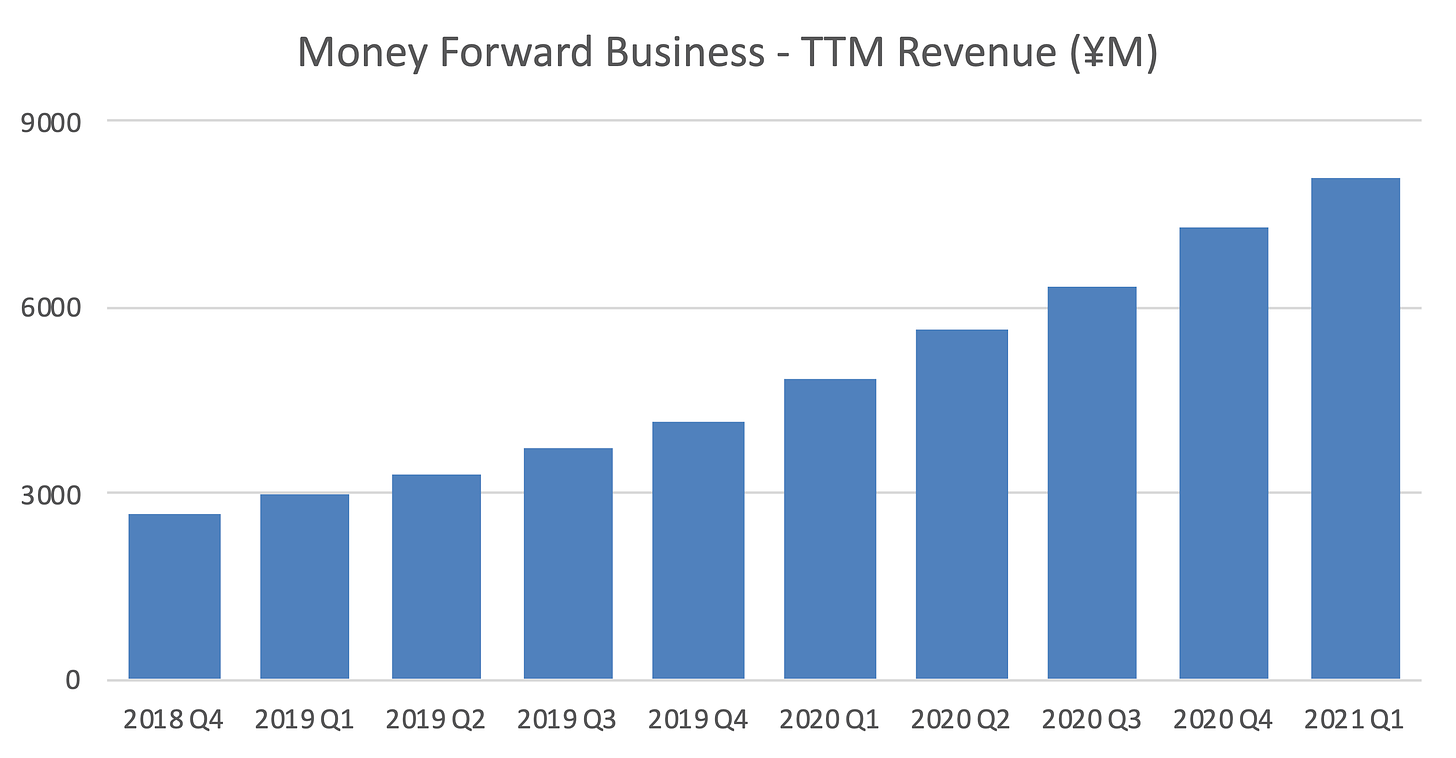

Money Forward Cloud, a SaaS application for Back Office Operations, is the key revenue driver. The SaaS product ranges from simple tax return software for sole proprietors to Cloud Accounting for corporations, in addition to a range of other tools: Invoicing, Expenses, Payroll, Attendance, Contracts. ARR reached $62 million in the past quarter (+37% YoY) driven by customer acquisition (+25% YoY to 154,000 paying customers) and ARPA increase (+10% to $405pa).

ME, was released in 2012 and is the number one PFM app in Japan reaching 12 million users. The freemium model allows users to connect bank accounts and credit cards to get a consolidated view of incomings and outgoings. Around 300,000 users pay for additional functionality, which generates around $15 million in annual recurring revenue (ARR).

The MARKET

There is a huge market for back-office SaaS in Japan. With over 4.5million sole proprietors and 1.8million SMEs, the TAM is estimated at around $12 billion. The government's promotion of digitalization (DX), combined with the introduction of remote work amid the pandemic, is driving increasing adoption of cloud services in Japan. Regulatory changes that simplify tax accounting, record keeping, and payments are key drivers for accounting software. Market penetration remains extremely low by global standards, which augers well for strong top line growth over the next several years. Money Forward partners with over 66% of Japan’s largest accounting firms to get the product to market. The client matrix is very much focused towards tech-centric, new economy companies, but we assume that even the older, more traditional companies will switch to the cloud (eventually) given compelling cost savings.

The MOAT

Money Forward competes against Freee (4478) at the SME-level. For mid-larger companies, the competition extends to Yayoi (part of Orix) and OBC’s Bugyo. While Yayoi and Bugyo are legacy on-premise players moving into the cloud, both MF and Freee, are growing much more quickly thanks to better UI/UX, and API connectivity. There is a complete absence of global majors (Intuit, Sage, Xero) due to the language hurdles and regulatory know-how.

The main competitive advantage for Money Forward is ‘Switching Costs.’ Once the software becomes embedded within an organization, it becomes ‘sticky’ and difficult to switch to an alternative provider. Money Forward is growing quickly, and advertising spend is geared towards rapid customer acquisition rather than short-term profitability. The growth in corporate ARPU is underpinned by the ‘land and expand’ strategy, while low and declining churn rate (1%) highlights the product stickiness.

The MANAGEMENT

MF has a strong management team and board of directors. MF was founded by CEO Yosuke Tsuji in 2012. With a Wharton MBA and experience at SONY and Monex Securities, Tsuji stands apart from many traditional Japanese bosses. CFO Naoya Kanesaka, joined pre-IPO in 2014, previously a fintech banker at GS. The management team is rounded out by CTO Nakade and COO Takeda, supported by an experienced bench of five external directors. Execution is like a US tech company – start with minimal investment, achieve market fit, launch add-ons, grow ARPA, expand customer base, improve competitiveness. The balance sheet is strong, with cash accounting for 75% of $100m in net assets, that can fund further acquisitions. Given the TAM and long runway, growth is correctly prioritized over shareholder returns.

VALUATION

As an early-stage growth company, we value MF using a EV/Revenue multiple and compare the stock with comparable peers. As can be seen in the chart below, MF trades at a sizeable discount to both Freee and Australian-listed Xero.

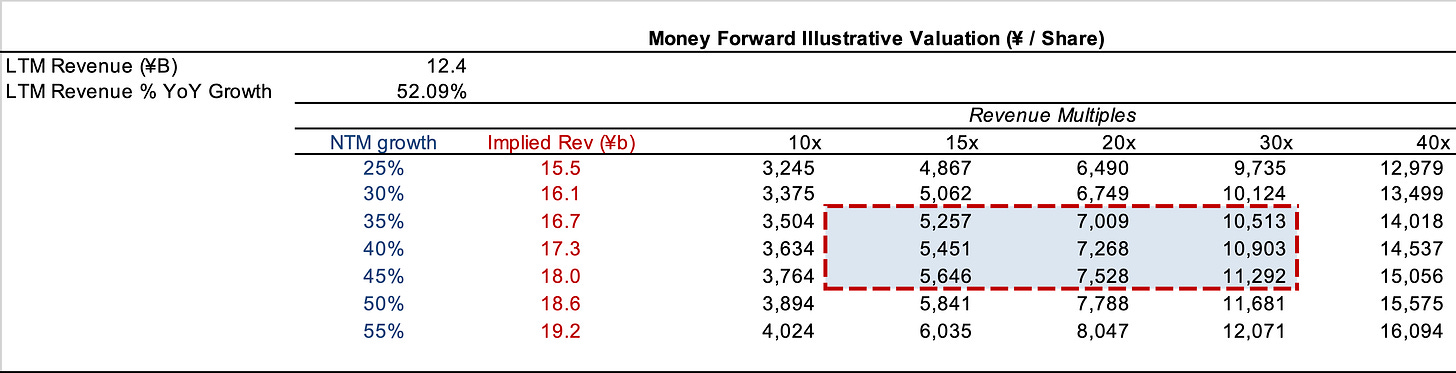

Below is a table that shows potential share prices based on a range of growth rates over the next 12 months as well as a range of multiples. We believe that MF’s lower revenue multiple is due to the market putting a low valuation on the PFM business. A re-rating of that business would be a huge catalyst for the stock price.

Japan Disruptive Innovation - Winners and Losers

Our Japan Disruptive Innovation Index saw 50 stocks rising from the 140 names that we track for the week ending Friday April 23, 2021. For reference, TSE Mothers was down -3.1% on the week.

🔺+30% Visional (4194, $2.1b), the HR Tech Platform and operator of the popular Bizreach placement site, listed on the TSE Mothers exchange this week. The stock rose as much as 50% above the ¥5,000 IPO price on Thursday before closing the week at ¥6,500.

🔺+14% Atled Corp (3969, $190m), the cloud-based provider of workflow systems, rose after reporting a FY operating profit of ¥783m, +33%. On the back of the strong demand for its products driven by the DX shift, the company sees OP rising again this fiscal year to reach ¥880m, +12% YoY.

🔻-18% Makuake (4479, $690m), the unique platform that launches new products and services online, reported 2Q earnings, posting a loss on the back of aggressive promotional spending. Gross Merchandising Value for the quarter rose +104% YoY, but slower than the previous quarter’s +107% YoY. That’s still fast!!!

Something for the Weekend 👀

This is well worth a listen for anyone interested in how the Softbank Vision Fund really invests its $billions.

Capital Allocators Podcast - Inside Softbank Vision Fund with Jeff Housenbold