PKSHA Technology – problem solver

Japan Disruptive Innovation

PKSHA Technology (3993) | Quick Look

Share price: ¥1,876 | Market Cap: $520m | EV/Rev

"Software is eating the world," wrote Marc Andreessen in a 2011 essay. He went on to say that, more and more major businesses and industries would be run on software and delivered as online services. The truth is that all major sectors of businesses and the world's economy were transformed by software and the internet. A decade later, AI and algorithms are about to transform software itself.

PKSHA Technology, a company that creates AI algorithms, is set to benefit from this shift. The company's algorithms employ a wide range of AI technologies, including Machine Learning, Deep Learning, Natural Language Processing, and Video Recognition. Founded in 2012, the company has seen rapid growth as businesses adopt AI to solve problems.

Algorithms are defined as "software logic that is designed intelligently to solve a problem". PKSHA's mission is to create algorithms as future software, solve social problems by using the power of algorithms, and develop businesses to create value in the post-digital information society of the future.

Recent Highlights

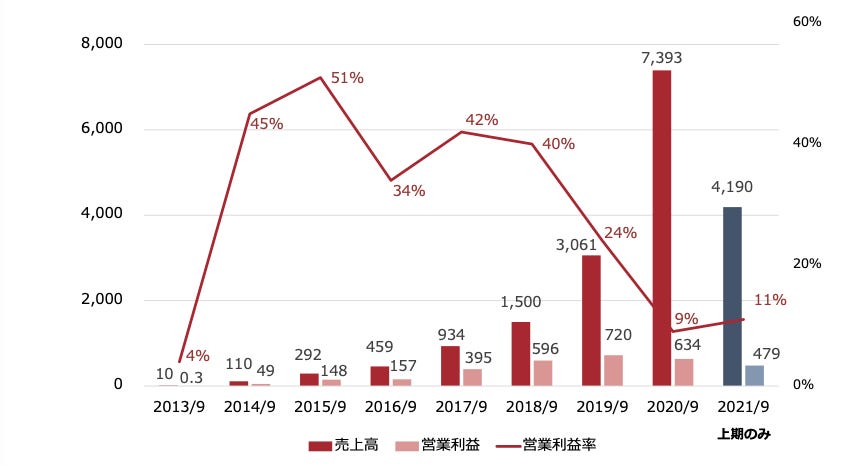

PKSHA has experienced rapid organic growth over the past few years, with sales growing from practically zero to over ¥3bn. Last year, the company acquired I-tech, a manufacturer of parking lot equipment, which boosted sales to more than seven billion yen. In terms of growth, the company expects sales to reach ¥25 billion by FY9/24 and operating profit to reach ¥5 billion, implying a four-year CAGR of 27% for sales and 60% for profits.

Sales rose 11% to ¥4.2bn in the first half of this year, while operating profits increased 17% to ¥0.5bn. For the full year, the company expects revenues to grow by 45% YoY and OP to rise by 63% YoY.

Product Offerings

PKSHA Technology offers several commercial solutions summarized below:

BEDORE: Uses Natural Language Processing. Creates auto-response engine using inputs from chat operations on the web, Line, and AI speakers, etc. Applications include customer relationship management systems.

CELLOR: AI-driven digital marketing tool for real shops; used to help build customer relationships

PREDICO: A predictive algorithm using accumulated historical data. Applications across demand predictions, optimal pricing, and real-time online line security for credit card approval and security.

HRUS: uses deep learning and computer vision to analyze and identify people and things with accuracy. Inputs from camera, smartphone, drones. Use cases across retail, security, infrastructure, care, education, detect human emotion, and monitor places.

MODEL

Based on its AI technologies spanning Machine Learning, Deep Learning, Natural Language Processing, and Video Recognition, PKSHA develops and sells products under two segments: Cloud Intelligence and Mobility & MaaS.

Cloud Intelligence (91% Profits)

Cloud Intelligence operations enable businesses to get more out of their current digitized assets by adding intelligence to the picture, thereby boosting efficiency and productivity. Engineers provide initial consultations for this business, which may take up to 2 months to figure out whether there is a solution. The initial consultation fee is covered by PKSHA and after winning the business, the client pays for set up (which can take 3-6 months), followed by recurring license fees. Cloud Intelligence generates over 70% of sales through recurring revenue.

Mobility & MaaS (9% Profits)

Mobility & SaaS adds digitization and intelligence to real-world spaces, with significant potential for productivity and security improvements. To achieve success in this business, PKSHA chose to fully acquire an operating company (I-Tech) rather than simply offer their product as a service. They see Japan’s parking technology is too far behind and instead of trying to win business from traditional Japanese companies, the acquisition enables them to quickly demonstrate their solution. Parking technology includes reservation, cloud integration, camera and sensor angle applications, and call center automation. PKSHA expects sustainable margins in this segment of around 5% and sales growth of about 10% per year through FY9/25.

MARKET

Globally, AI smart solutions are still in their infancy and lag even further behind in Japan. In spite of a low base, PKSHA and its competitors have reported fast adoption rates. In order to assess the company's long-term potential, we look at the overall market potential and drivers.

Cloud Intelligence has a long runway for growth. The world software market is estimated to be between $200-$250 billion. Cloud services account for about $35b, while algorithm software represents a mere fraction of this pie at $7b but is growing at 70% per year.

Due to Japan's declining working population and late adoption of cloud services, the country has been slow to adopt AI solutions. However, AI solutions are now central to many fields including security, call centers, client connection, and commerce to name a few. The use cases of AI will only continue to expand and develop in the future. In this respect, we believe PKSHA will experience an extended period of growth.

A Key Value Proposition of Mobility & MaaS is the shift to Smart Cities. Today's online lifestyles offer many benefits, including convenience, increased information availability, shared services, and labor flexibility. On the other hand, unorganized information still creates friction in physical space, such as traffic gridlock and parking congestion. "Smart Cities" aim to tackle physical problems with artificial intelligence in a potentially enormous market. The total addressable market (TAM) for smart cities worldwide could be worth between one and two trillion dollars, with Asia regarded as having the greatest growth opportunities.

OUTLOOK

Founder Katsuya Uenoyama (39 yo) remains at the company's helm as CEO. His shares are valued at $170mn based on his ownership of 9.4 million shares, or 30.6 percent of outstanding shares. As such, his interests are aligned with the long-term value creation.

As an early mover in the AI space, PKSHA has developed several diverse partnerships including Autos (Toyota; Denso), Telco (NTT Docomo), Education (Benesse), Insurance (Tokio Marine), and Credit Cards (JACCS).

PKSHA's competitive edge comes from its AI engineers. The company has over 120 engineers on its staff and expects a net addition of 50 for the current fiscal year. The company's aggressive increase is indicative of the opportunity it sees in the next five years as it targets revenue of ¥25bn.

VALUATION

Valuations, as shown in the table below, may seem rich on the surface. Nevertheless, the company is still just beginning to address the potential of its current market segments. Growth will likely accelerate significantly in the years to come.