Rakus (3923) | Update

February 18, 2022: Share Price: ¥1,736, Market Cap: $3.5b, EV/Rev: 15x

The stock price of Rakus, a provider of cloud-based software for business expense management, has been on a wild ride since we first wrote about the company last year.

There is no denying that Rakus has had an amazing share price run in the first eight months of 2021, as the company chalked up strong sales growth and investors bought into the theme of Digital Transformation. However, the share price peaked on September 15 at ¥4,775 and has since declined by 65% to close at ¥1,736. For comparison, the TOPIX benchmark is down -8.2% while Mothers is down -40.2%.

Has there been a reversal in the underlying fundamentals that have precipitated that share price fall? The simple answer to this question is NO.

Instead, one can argue that the share price had simply moved ahead of its fundamentals. Then, as inflation expectations started to feed through into higher global interest rates, growth stocks collapsed. Japan’s small caps were not spared.

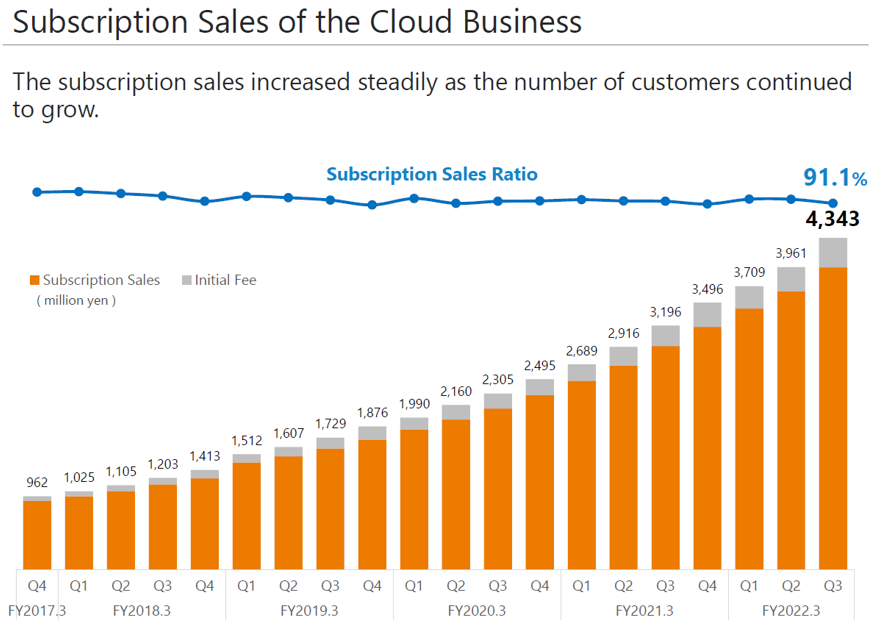

THIRD QUARTER RESULTS STRONG. Despite the significant sell-off, we have ample evidence from the 3Q FY3/22 results that the on-going DX shift in Japan is alive and well, and that Rakus continues to see solid demand for its cloud services. Subscription sales rose 35% YoY in Q3 to reach ¥4.3b.

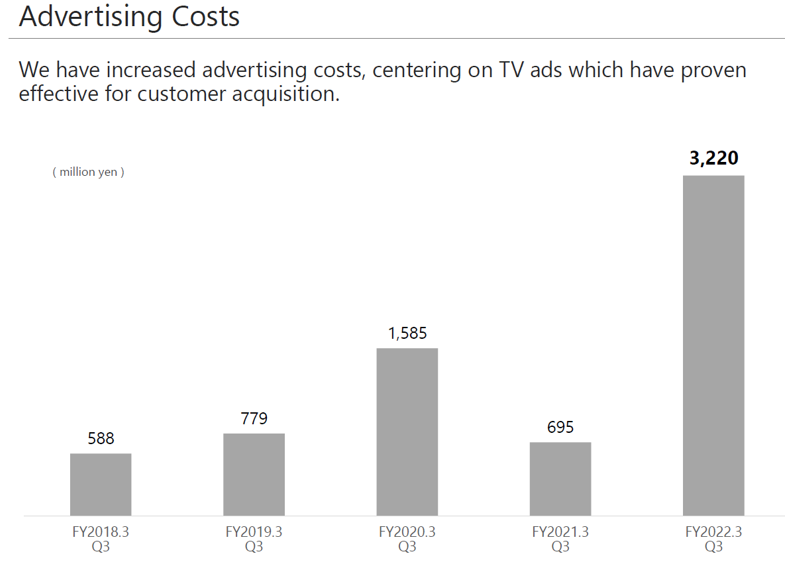

Although operating profit declined to ¥0.3bn, this was largely due to higher advertising spend in the quarter, a factor that the company had already guided towards.

The long-term growth strategy continues to pay significant dividends, with the company’s core SaaS cloud offerings (Raku Raku Seisan and Meisei) continuing to pull in more and more new subscribers.

Over 90% of the company’s cloud revenue is recurring income and with gross margins approaching 70%, pushing customer acquisition aggressively at the expense of short-term profits makes a lot of sense.

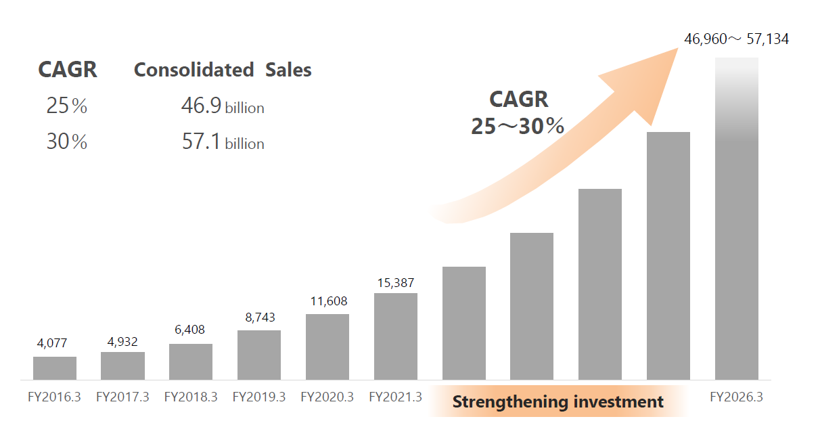

MID-TERM PLAN. Rakus disclosed a new five-year medium-term plan at the end of FY3/21, calling for sales to grow at a CAGR of 25-30%, and net profit to reach ¥10b by FY3/26. The early evidence suggests that the sales targets are likely to be exceeded, whilst the profits will rebound as SG&A normalises.

To conclude, the fundamentals for Rakus have improved over the past year. We believe the company will continue growing at high rates for several years to come, given that the DX shift in Japan is still very much in its early stages. We like that the company is prioritising top line growth over near-term profits, as client acquisition is the key at this stage of development.

After a 65% pullback from the highs made in September 2021, with the fundamentals looking more robust than ever, Rakus is certainly one name that should be on every growth watchlist.