Rakus (3923) | Quick Look

Share Price: ¥2,067, Market Cap: $3.5b, EV/Rev: 26x

The MODEL

Rakus is a cloud-based Business Spend Management (BSM) solution that helps companies and employees improve efficiency in tracking and settling expenses. Rakus’ expense system facilitates fast and accurate expense reporting that enhances productivity, compliance, and controls overspending.

Established in 2001, the company IPO-ed on the TSE Mothers in December 2015. In February 2021, the company was promoted to the 1st Section of the Tokyo Stock Exchange. Founder and CEO Takanori Nakamura set at three-year 30% annual growth plan through FY3/21 and over the past two years the company has exceeded this guidance. For FY3/21, the company is on course to surpass the target again, despite sales activities being restricted due to COVID-19.

Rakus has two segments: the mainstay Cloud Business (80% of Sales) and the IT Outsourcing Business (20% of Sales).

The Cloud Business has a portfolio of products targeted at Japanese SMEs, with the key revenue driver being Raku Raku Seisan - a cloud based expense manager, accounting for 50% of segment sales and growing at 42% over the last quarter.

The remaining Cloud Revenue comprise 4 other key products, listed in the table below. Over 90% of revenues for the cloud business are recurring and generate high margins (OPM is around 30%).

The IT Outsourcing Business provides a consistent revenue stream due to the sustained demand for IT personnel in Japan. See our discussion on the need for DX in Japan and its constraining factors here.

The business model consists of hiring inexperienced personnel, training them, then outsourcing. The topline has been growing at strong double digits. With a relatively low personnel base of 460 IT engineers, there is a continued opportunity to supply IT personnel to tech-starved Japanese corporates. The normalized OPM is around 10-12%.

The MARKET

Raku Raku Seisan (TAM ¥70b): the company defines its total addressable market as 100,000 SMEs that have between 50 to 1,000 employees. Most of these companies use paper-based systems or spreadsheets to manage their expenses, from workflow to calculation. The company estimates that the addressable market is worth ¥70bn. With an estimated 60% of smaller companies still using spreadsheets, Rakus aims to convert at least 20,000 companies to their system, still a significant growth opportunity versus the current 7,800 companies currently using Seisan.

Potential competitors in the BSM space include SAP’s Concur, which targets large enterprises at higher price points, and EasySoft (a subsidiary of Panasonic). That said, Money Forward (3994) and Freee (4478) are also likely entrants in the space. However, Rakus is clearly the leader, and it a fast-growing profitable business for them.

Raku Raku Meisei (TAM ¥30-50b): The company believes the TAM is in the range of ¥30-50b. Other players in the market for digital billing software include Infomart (2492). Sansan (4443) is also looking to make inroads with its Bill One product. The respective current sales of Rakus and Infomart are ¥1bn and ¥2bn, respectively, suggesting still very low penetration rates and ample room for growth.

The MOAT

Rakus has benefited from an overall market trend toward the cloud and an efficiency drive for businesses to streamline expense management. It is the key player in the growing local market for BSM. The company has been able to maintain high growth rates, with strong profitability, and once clients adopt the system churn is low. This suggests that the key competitive advantage for Rakus is its first mover advantage and switching costs – once on the system, it becomes difficult and costly clients to change service providers.

The MANAGEMENT

Takanori Nakamura started at NTT in 1996, then formed a start-up, Digital Network Service, before establishing Rakus in 2000. He currently holds just over 34%, or 62m shares of the company, valued at over ¥130b - his interests are aligned with all shareholders.

CEO Nakamura has a clearly articulated a goal of being in the top 100 companies in Japan by market cap. In a recent interview, he articulated this as achieving a market cap of ¥1.5 trillion versus the current market cap of ¥400b. YouTube Interview

We believe the upcoming Mid-term plan (May 13) will be geared towards turning Rakus into a TOP 100 company in Japan. CEO Nakamura is a keen student of US SaaS companies and frequently refers to them as a potential model for his company. We hope to see concrete plans to grow sales and profits to achieve this objective.

VALUATION

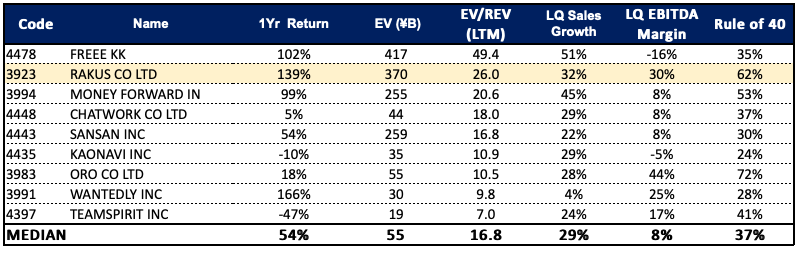

On a scorecard of the Rule of 40 vs EV/REV, the stock looks relatively attractive within the Japan SaaS universe. The higher valuation multiple, reflects the higher growth and superior profit margin. We think the MTP could be a key catalyst for the stock, with Rakus likely to target a higher growth rate going forward.

Japan Disruptive Innovation - Winners and Losers

In a shortened 2-day trading week post Golden Week holidays, the TSE Mothers Index of growth stocks fell –3.3% WoW, with losses on both trading days. Our universe did not fare much better with only 40% of our stocks recording positive gains.

🔺+16% MARKLINES (3901, $400m) – provider of information on global auto production data online to companies – rose after reporting 1Q earnings that saw both sales and OP growth accelerate.

🔺+12% Wantedly (3991, $290m) – the SaaS professional networking company – continued its meteoric rise, which started in mid-April after reporting strong 2Q earnings and higher guidance.

🔻-14% Freee (4477, $4b) – the provider of cloud-based accounting software - sold off with the overall market rotation out of growth, tech, and small caps, and into value -> signs of inflation start to appear in the US.

🔻-47% AI Inside (4488, $580m) – the AI firm - plummeted on news that NTT West would not renew unused licenses for its optical character recognition tool. Of the 9,284 licenses as of March 2021, 7636 would not be renewed.

For information on all of the movers and names in our universe, please take a quick look at the Google sheets

Google Sheet

Have a great weekend!