TeamSpirit (4397) | Quick Look

Share Price: ¥1,377 | Market cap $200m | EV/REV 7x

Business MODEL

Human Capital Management (HCM) is a concept that views workers as individuals with skills and talents – something that can be managed to help a business to grow. New digital technologies enable HR leaders to provide an engaging and personalized employee experience.

When people talk about HCM, they are usually referring to a suite of modern IT applications that cover all the touchpoints between an employee and employer: Talent Management, Workforce Rewards, Workforce Management.

A well-designed HCM solution can help companies to:

Attract and Retain Talent

Optimize Workforce and Management Spending

Respond with Agility to Change

Streamline HR Operations

TeamSpirit focuses on Workforce Management (WFM). WFM systems organize information to give a complete record of human capital, so that organizations can improve worker productivity, reduce labour costs, and minimize compliance risks.

TeamSpirit operates a cloud-based software-as-a-service (SaaS) delivery model, which is quickly becoming the norm for HCM technology. Cloud solutions allow companies to quickly deploy software, lower costs, and enable easy upgrades.

TeamSpirit connects to other tools within the broader Enterprise Resource Planning (ERP) system. The platform integrates with other tools, such as document signing, expense management, and remote communication, so that information can be analyzed in real time.

It is not just the technology that has changed. The workforce is transforming too – into flatter, more agile networks of teams, becoming more mobile, global, and diverse. These trends underpin the rapid adoption of cloud computing.

What are the key sales drivers?

Demographics. Japan’s population is aging and shrinking fast. Over the next 40 years, the population of 127m will shrink by around a quarter. The policies of Abenomics – economic growth, inflation, public debt stabilization – rely heavily on structural labour-market reforms. Japan urgently needs to boost the labour force by adding more women, older workers and foreign workers. HCM software, like TeamSpirit, enables “work-style reforms” designed to increase labour flexibility.

Digital transformation. Japan is hurtling towards its 2025 Digital Cliff, its digital shortcomings brought into sharp focus by the Coronavirus. DX has become an urgent policy concern, so much so that the Government has recently set up a Digital Agency to speed things up. The spread of Covid has brought irreversible changes to society and the way we work. For companies to grow under this new normal, digitalization is becoming more important. ‘Digital Anywhere’ means just that and TeamSpirit can help companies to support a more mobile and agile workforce.

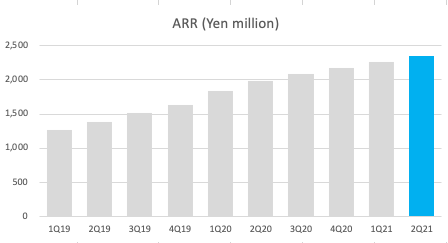

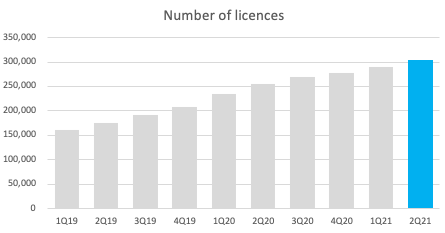

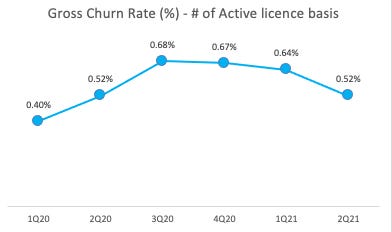

TeamSpirit generates over 90% of revenue from recurring sources. The key KPIs that drive Annual Recurring Revenue (ARR) are the number of licences and churn.

Chart: ARR grew 19% to ¥2.4b in the most recent quarter

Chart: TeamSpirit added 13,560 licences in Q2

Chart: Gross churn at 0.52% remains low; strong customer acceptance

The company’s mid-term plan calls for 1 million licenses and ¥10b in sales by 2025. The current Annual Recurring Revenue (ARR) currently stands at ¥2.3b, which implies that the business could grow 4x over the next four years.

Is it an attractive market?

Looking at this from the top-down first. Globally, businesses spend around $180b on ERP software. Client Relationship Management (CRM) made up a quarter of the spend, while HCM accounts for just less than 10% of the total.

Fortune Business Insights estimates that the market size stood at $16b in 2019 and is expected to reach $32b by 2027, for a CAGR of 9% over the next several years.

The key global players include: Automatic Data Processing, SAP, Oracle Corp, Ultimate Kronos Group, Workday, Cornerstone onDemand and Ceridian HCM Holding.

The Japanese market remains relatively small part of that global pie. The global HCM players are already operating in Japan, especially among the large multi-national companies. Just as an example here is the client roster of Workday in Japan: Fast Retailing, FujiFilm, Hitachi, Mizuho, Nissan, Nitori, Orix, Rakuten, Ricoh, Sansan, SONY, Toyota, Trend Micro.

The shift to cloud-based HCM is still in the initial stages in Japan. TeamSpirit cites ITR Market View to size the market for Employment Management SaaS at around $100m currently in Japan. This is expected to grow to around $300m by 2024.

The market though is potentially much larger than that. Many larger companies have their own legacy systems on premise. The lack of IT support for these legacy systems due to the ageing workforce is forcing many companies to open up and shift systems into the cloud, particularly post Covid. Many companies are still using timecards and Excel!

A quick back of the envolope calcualtion: Assuming that all Mid-to-large company employees (~30m) are potential users of HCM software, the market TAM could be worth around $2b.

The key Japanese players in WFM include: TeamSpirit, King Of Time (Human Technologies), Akashi (SonyBiznet), ByeBye Time Card (Neolex), Kincone (Soulware)

Is Team Spirit a winner?

It is early days for cloud-based HCM software makers and TeamSpirit is a small company with Annual Recurring Revenue of just $20m. What is for sure is that the market has exceptionally low penetration. TeamSpirit has around 1,400 corporate clients out of a total mid-large universe of around 55,000 enterprises and 1.8m SMEs. The target is clearly to grow the enterprise user base and the core KPI is to grow Licence ARR at above 30% per annum. This makes sense, given the core competitive advantage for cloud-HCM is likely to be switching costs. It is vitally important to grow its customer list before other local and global competitors can expand their share. We feel that the competition from the likes of Money Forward and Freee could intensify as those companies move from pure accounting software to a broader ERP offering. This is already starting to happen.

Is it a good stock to own?

The stock is trading at the bottom of its 52-week range (¥1,550 to ¥2,980) following a weak Q2 results (Apr 9). The stock fell around 20%, as the company lowered its full year sales guidance from ¥3.15b to ¥2.9b (+18% YoY). That is what happens when growth slows at a company with high sales growth.

The growth in the number of licences is the chief culprit here. Licence additions slowed to 13,560 in Q2, down from c20,000 the year before. The company partially blamed that on a delay in booking around 2,000 licences, pushed now into Q3, but it said the same thing at the end of Q1.

The company’s strategy is to target larger companies, which have both a higher number of users and a higher fee opportunity (upselling services). However, this transition is taking longer than expected, partly due to the slow decision making process at larger companies, probably hindered by COVID.

At the current price of ¥1,570/share, expectations are pretty low. The stock trades in line with the Japan SaaS average at around 9x EV/Sales. Given the size of the TAM and the low penetration of cloud-HCM, we believe the market cap will be significantly higher than the current $250m over the next 5 years.

Suga’s Trojan Horse

When I first came to Japan as a student over 20 years ago, my Sempai guided me though all the university entrance procedures. What stood out most was the need to have a Hanko, or a personal seal. As a new gaijin in Japan, carrying a Hanko was cool - I felt part of the team and owning my own hand-carved katakana seal proved it.

After graduating and moving into the real world, the coolness factor vanished. It was replaced by a recurring nightmare. The all-powerful Hanko was needed for everything. Bank account? Hanko. Marriage? Hanko. Business registration? Hanko. EVERYTHING needed a bloody Hanko. This isn’t just a gaijin sob story - it's worse for Japanese workers.

The Hanko is a handbrake on getting things done. Every contract requires a Hanko to be certified by law. Go in person with a particular Hanko certification, and physically put a seal on the paper. The government recently identified over 10,000 (Yes OVER ten thousand!) procedures that needed a Hanko, and this was just in the public sphere! The private sector is in on the game too. It is almost impossible to open a bank account or buy real estate without a Hanko. Despite its antiquatedness, ease of falsification, and downright inefficiency, it is still widely used. Even with widespread agreement that the Hanko impacted productivity and restricted digitalization, every attempt to reduce its importance fell flat. Then came COVID-19 and PM Suga.

COVID-19 brought home how low tech much of Japan had become. As the state of emergency was enacted and physical contact restricted, Japan found itself less able to adjust to work outside the office. The numbers speak for themselves. A Ministry of Health, Labour, and Welfare (MHLW) study showed that less than 30% of office employees worked from home during the lockdown from April-May 2020. The reason - companies were not equipped with IT to enable remote work. Japan has long prided itself on doing business face-to-face, but even the powerful business lobby, the Keidanren, realized it was time to give up the old ways.

Prime Minister Suga, who took power in late 2020, made "digitalization of the government" one of his top priorities. A Digital Ministry was set up and funded. Taro Kono, Japan's minister for administrative reform, ordered government offices to stop requiring Hanko stamps on all official documents. A sign of desperation but also one of necessity. It will not be easy to dismantle a system that has been in official use since the Meiji Era. Nevertheless, the entire digitalization project rests on the speed at which these antiquated procedures can be eliminated. The death of the Hanko is the trojan horse that will allow digital transformation to take hold, not just in the public sector, but across the entire society.

🗞 NUGGETS 🗞

Double vision. Softbank Vision Fund 2 ramps up. At the end of December SVF2 held 26 companies. This week has seen a flurry of deals. SFV2 to invest $500m in Swiggy, an Indian food delivery company. Others deals include an investment in Indian fintech Zeta; Samba Nova, a US AI data analytics platform; Tempo, the AI home-fitness start-up; and retail analytics firm Trax.

Hot chip. Sales of semiconductor fab equipment surged 19% in 2020 to $71b. Competition between Samsung and TSMC remains, but China now represents the largest single market for WFE at $19b (Japan is at $8b). Tool sales likely to spike again in 2021, with TSMC lifting capex this week to $30b.

Let the engagement begin. The $20b bid for Toshiba by PE firm, CVC, sets the stage for an “era of activism.” Under the right management and ownership, Toshiba could deliver vastly improved earnings and shareholder value. The transaction may never go through – there are a lot of hurdles to clear – but Japan remains the largest untapped market for active investors.

Chalk and cheese. While Toshiba lurched from crisis to crisis, Hitachi has methodically improved governance and cleaned up its balance sheet. Gone are some of the non-core assets, freeing up capital for M&A. The Nikkei reported that Hitachi will dispose of its Metals unit to Bain for $7b. Those funds will partially fund a $10b acquisition of US software engineer, GlobalLogic and the purchase of Kyoto Robotics – a global leader in 3D vision for pick-and-place robots.

📈 MOVERS and SHAKERS 📈

This week, just under 50% of the 140 stocks in our Japan Innovation & Disruption (JID) universe rose, as the TSE Mothers Index of growth stock eked out of 0.5% gain.

🔺+44% Wantedly (3991, mkt cap $250m) the SaaS professional networking company rose after reporting Q2 operating profit of ¥208m, +58% YoY. The company also lifted its FY sales forecast to ¥3.4b, above its earlier forecast of ¥3.1b, on growth in its SNS business.

🔺+26% RPA Holdings (6572, mkt cap $450m) the Robotic Process Automation business reported FY2/21 earnings, with 4Q sales and OP up +7% YoY and 85% YoY, respectively. The company is guiding for 37% OP growth this fiscal year.

🔺+19% Money Forward (3994, mkt cap $2.2b) the provider of cloud account software services reported 1Q Operating Profit of ¥80m vs a loss a year ago. Sales rose +45% YoY to ¥3.5b, with ARR up +35% to ¥9b.

🔺+16% BASE (4477, mkt cap $2.2b) the online shop creation platform rose as alongside a 4th wave of COVID-19 infections in Osaka and Tokyo. BASE is seen as a beneficiary of stay-at-home measures.

🔻-11% Grace Technologies (6541, mkt cap $730m) the outsourced producer of "e-manuals" for manufacturers fell as it was reported that its Chairman Koji Matsumura passed away at the age of 66.

🔻-19% TeamSpirit (4397, mkt cap $230m) the Workforce Management systems for human resource departments reported disappointing 2Q earnings. The company lowered FY8/21 guidance for sales to ¥2.9b from ¥3.2b and OP to ¥125m from ¥260m as large client acquisition was taking longer than expected.

🔻-25% Vector (6058, mkt cap $450m) the Public Relations firm reported inline FY earnings. However, the stock was hit as OP guidance for the new fiscal year of JPY4b (+73% YoY) missed analyst estimates.

If you made it all the way to the end, thank you. Please do consider sharing the NipponNuggets with your social networks. 🙏

Oh yeah…and have a great weekend!