📚 MEGA TRENDS - RENEWABLES 📚

The future is Mirai?

Petrol heads have been busy test-driving Toyota’s new hydrogen fuel cell vehicle (FCEV). The “Mirai” in Japanese means "Future" and it is a wonderful non-polluting car that emits only water from its tailpipe. Of course, to produce the hydrogen in the first place we need to pass electricity through water and right now none of that electricity comes from renewable sources.

Watch👀: Autogefühl Checks Out The New Toyota Mirai Hydrogen Fuel Cell Car

Green or not, Japan is gearing up for a hydrogen future. The upcoming Energy Strategy will include hydrogen in the mix for the first time. Hydrogen could account for around 10% of electricity generation in the future and it will get “greener” over time.

A few companies are hoping that hydrogen will also power cars in the future. ENEOS just announced that it will start building out its hydrogen station infrastructure. Toyota’s Woven City, a smart city just being built on the slopes of Mt Fuji, will be powered by hydrogen, and the inhabitants will no doubt be driving around in their Mirai (if they have a spare $70k in the bank).

Watch👀: Introducing Woven Planet Group

And that is the rub. FCEVs are expensive. Mercedes just announced that it is killing its plan to develop FCEV passenger cars, after working on the technology for over 30 years.

Hydrogen fuel-cell cars are at least twice as expensive to build as an equivalent battery-powered car in the manufacturing. As a result, sales prices are not reflective of the cost.

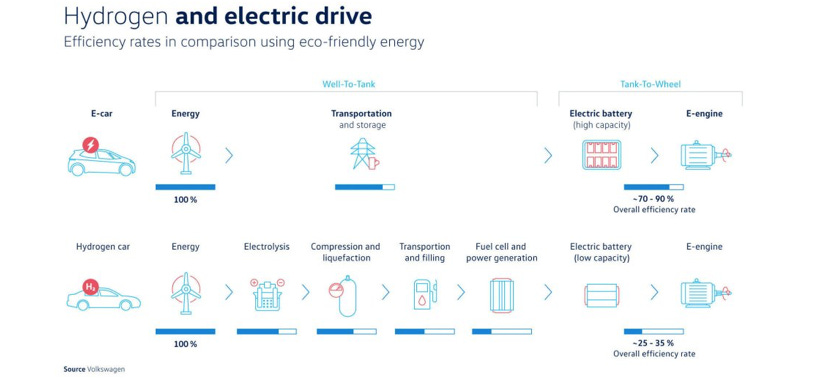

VW concluded:

Everything speaks in favor of the battery, and practically nothing speaks in favor of hydrogen.

Aside from Toyota and Hyundai, virtually every other auto manufacturer is betting that battery (B)EVs are the future. This past week, FORD announced that ALL its passenger cars in Europe will be electric by 2030.

With tightening emissions regulations and massive gains in both the performance and cost of BEVs, the shift to a low emissions future is picking up speed. As BEV ranges expand with each new model launch, EVs are expected to surpass ICE in performance and consumer cost by 2025. There seems little need for consumers to consider FCEVs.

In Japan, PM Suga has pledged carbon neutrality and announced switching completely to NEVs by the mid-30s. However, the new regulations are not very stringent and define NEVs to include BEVs, FCEVs and Hybrids. The accompanying efficiency target of 25.4km/liter is lax, given that the current Toyota Yarris hybrid can clock up 36km on a single liter.

If Japanese automakers stick to the current hybrid technology, there is a very real danger that they fall behind global peers. To avoid that trap, they will need to meet rising consumer demand for BEVs in China, Europe and California. Not surprisingly, Toyota is hedging its “mirai” by announcing this week two new BEVs for release in the US in 2022.

🗞 NUGGETS 🗞

The Japan Paradox: Professor Ito is the godfather of Japanese corporate governance. The Ito Review of 2014 on Sustainable Growth was the launchpad for PM Abe’s third arrow and governance reforms. He asked an important question,

How have innovative Japanese companies fallen into a paradox of low profitability?

THIS study from the Brookings Institution on Japanese Innovation answers that question. Japan allocates more cash to R&D than any other country and files more patents, but the results are underwhelming. Japanese R&D lags in global cooperation and that the leads to lower quality results. Whereas 25% of German patents have global cooperation, only 3% of Japanese patents do. The results have important conclusions for diversity and immigration.

Talk about Diversity: Most companies talk the talk on ESG, but not many walk it. Nearly all companies have lofty values that they aspire to and probably most of them fall short. The resignation of Tokyo Olympics chief Yoshiro Mori has put the spotlight back onto gender politics. Diversity is one area where Japanese companies fail spectacularly. Refreshingly, Japanese software company Cybozu, took out a full-page ad in the Nikkei lambasting its own lack of board room diversity.

It’s three middle-aged men, It’s truly embarrassing.

Diversity is not just a nice thing to have – as the above article on patent quality proves – it is fundamental to improved results. The pressure to reform is ON

The Big 3: Japanese CEOs are not celebrated like movie stars in Japan. Compared with Elon Musk, Mark Zuckerberg or Jeff Bezos, Japanese leaders are completely unknown. But three really stand out – Softbank’s Masayoshi Son, Fast Retail’s (Uniqlo) Tadashi Yanai, and Nidec’s Shigenobu Nagamori. The Nikkei recently caught up with Nagamori after the Nikkei hit 30,000 for the first time in over three decades - he remains optimistic on stocks and the Japanese economy.

Global warming is one the biggest problems of all and that will give rise to many new business opportunities. EVs, robots and drones are trends that will last for 50 years.

📈 TOP MOVERS 📈

💰💰💰

🔺+30% Giftee (4449, Mkt Cap $1.1bn), the e-gift giver, had a strong week after Daiwa Securities lifted their target price to ¥4300. The move also came after the company reported strong earnings at the end of last week.

🔺+27% Neural Pocket (4056, Mkt Cap $900mn), Japan’s leading AI image recognition player reported 145% top line growth. The demand for AI services continues to gather steam as Japan's pushes forward with digital transformation.

🔺+16% Brainpad (3655, Mkt Cap $350mn) is starting to see a recovery in its data consulting business after a slow start to that year due to the pandemic.

💣💣💣

🔻 -16% Medpeer (6095, Mkt Cap $1.2bn), the provider of SNS services for medical companies, reported 340% growth in operating profit on the back of increased demand for web lectures and advertising. Profit taking?

🔻-16% Rakus (3923, Mkt Cap $2.8bn) the cloud-based expense management company fell despite reporting strong 3Q earnings last week. Post Friday’s close the company announced a secondary share placement to increase liquidity and that it is graduating from Mothers to the TSE First Section.

🔻-20% AI Inside (4488, Mkt Cap $1.7b) the AI software provider had another rough week following a 13% fall the week before. Q3 earnings disappointed with flat QoQ growth, below market expectations.