Q1 is a wrap. A good riddance to fiscal year 20.

For those of you who shifted out of high-flying growth stocks and rotated into deep value, congratulations. Enjoy a glass for me…🍾🥂

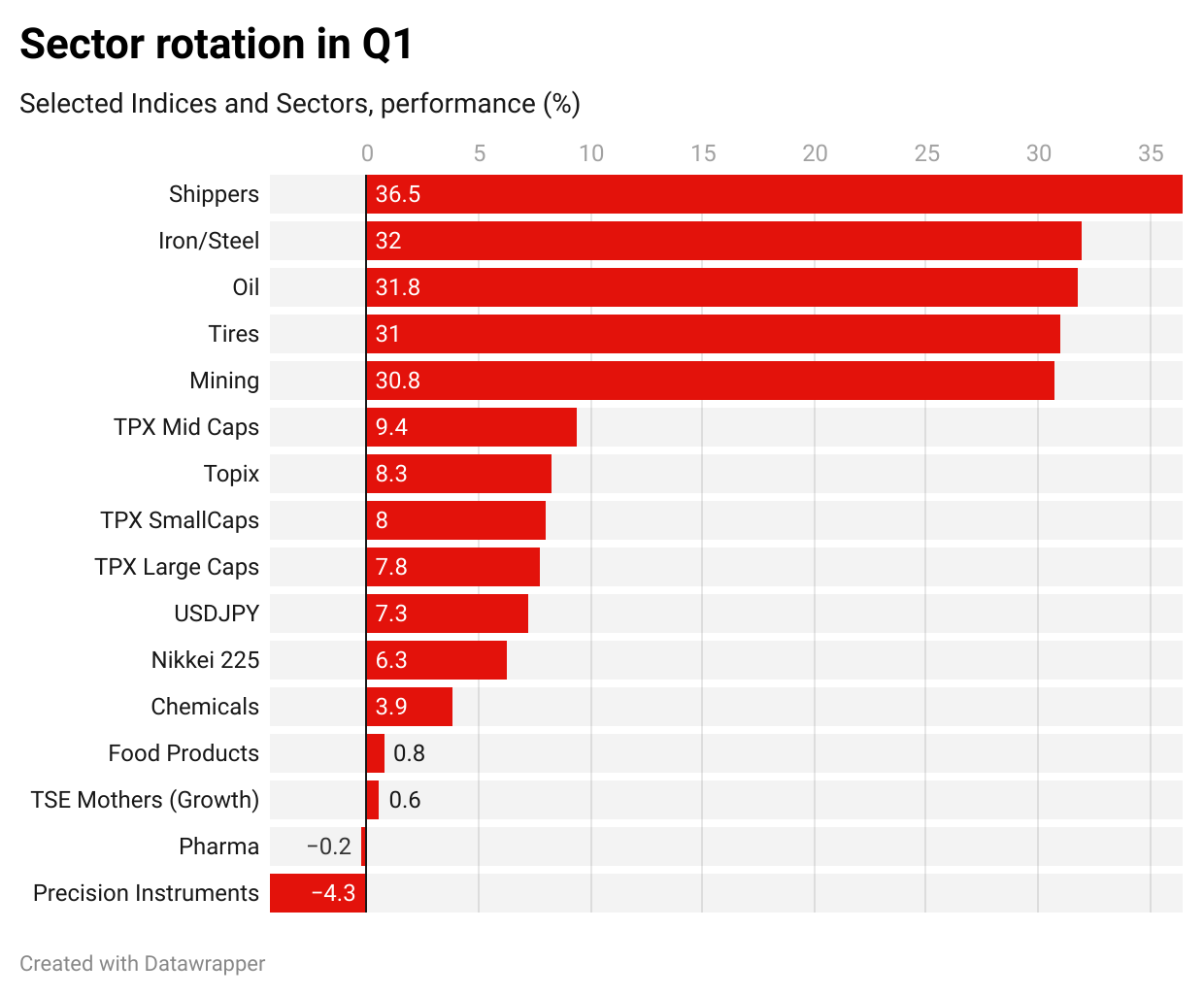

In Q1, Japanese equities marked an impressive performance. The Topix rose +8.3%. The 7% decline in the yen did eat away most of those gains for offshore investors though.

The strong topline numbers, however, belied a difficult quarter for stock pickers. Higher interest rates caused a brutal rotation out of growth and into value. Last year’s unloved stocks, particularly those trading below Book Value, suddenly could do no wrong. On a sector level, the big winners included Shippers (+37%) and Steel (+32%).

Last year’s darlings, small cap “tech” stocks in the TPX Mothers, barely eked out a positive gain. Even within small caps, investors shifted from growth to value, causing a significant 7% spread between Mothers and the TPX Small Index.

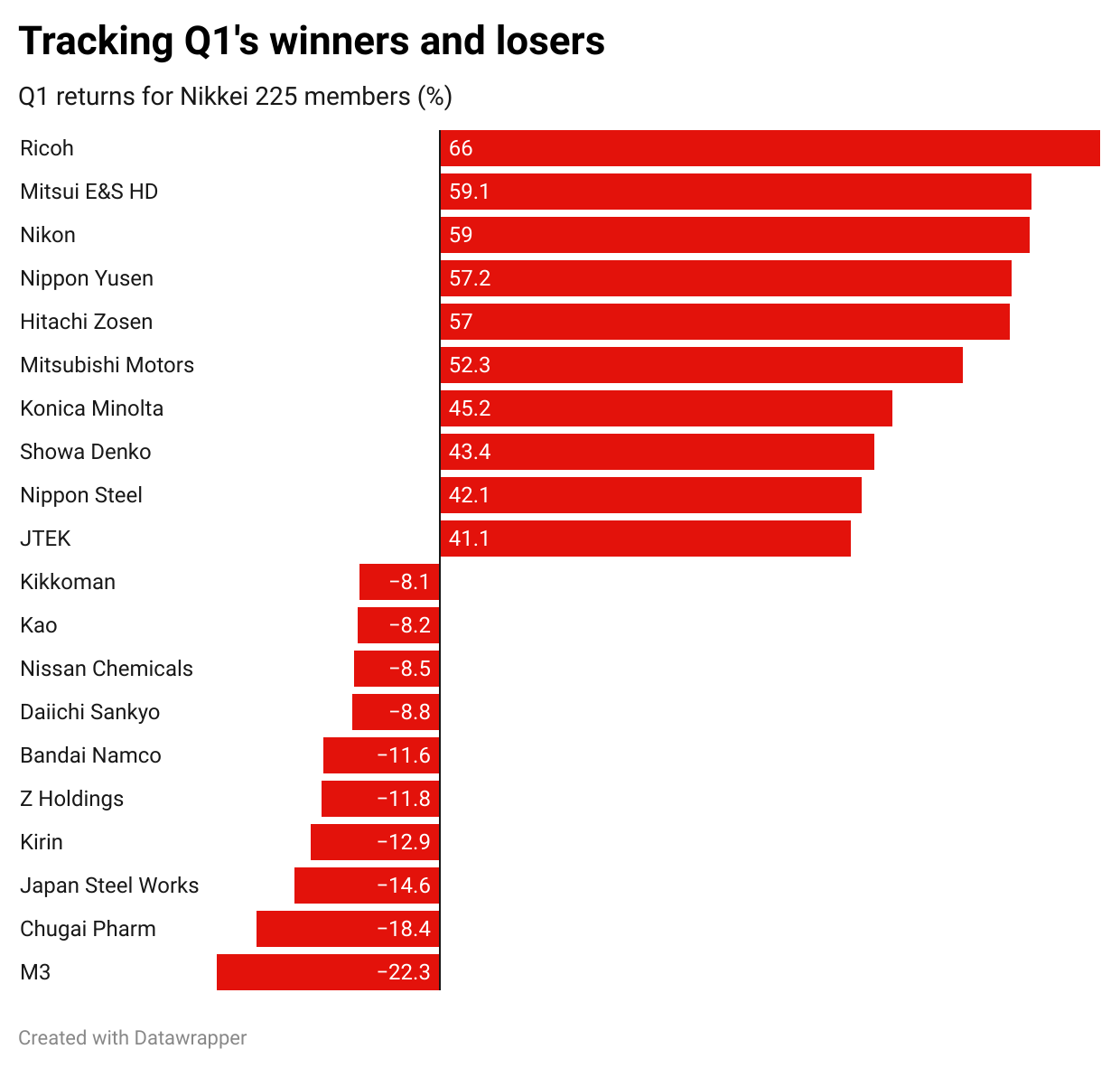

We break out the winners and losers in the following chart:

Japan is a great hunting ground for value stocks and is arguably the biggest beneficiary of rising inflation expectations. Not surprisingly, Old school Japan had a great quarter - Office Equipment (Ricoh +66%; Konica Minolta +45%), Industrials/Autos (Mitsui Engineering +59%; Mitsubishi Motors +52%, Hitachi Zosen +57%; JTEK +41%) and commodities plays (Nippon Yusen +57%, Showa Denko +43%, Nippon Steel +42%). Some of the duds included M3 (-22%) and Z Holdings (-12%).

As we bid farewell to Q1, it will be interesting to see if Value continues to outperform Growth. Much probably depends on the bond market. A further ratcheting higher of yields could continue to weigh on still high valuations in the growth space. However, the major global mega trends are not going away. Decarbonization, Data, Automation, and AI, to name but a few, remain powerful forces. Whether that shift back to growth happens this quarter, or later, we think that Japan’s smaller, more agile, tech-savvy small caps offer better long-run return than the “old” value stalwarts.

We see plenty of reasons for optimism.

🗞 NUGGETS 🗞

A great read on start-up growth companies across Asia. One of our favourites AI Inside makes number 11 of the list. Read more

In Japan, the rise of fast-growing startups can be attributed to a dramatic shift in risk appetite in recent years. Startups used to be a rare breed in Japan, where talent and capital were tightly kept inside big companies under a lifetime employment system. Today, that has changed, thanks largely to a series of successes, such as the watershed 2018 initial public offering of Mercari, an e-commerce company which blew away the widely held view that startups are small and risky.

Remember Hitachi? It’s a software company now, writes the WSJ, following the $9.6 billion acquisition of Global Logic. Read more

Nomura will have to sharpen its focus on risk management after facing up to $2 billion in losses from a single U.S client. Read more

Softbank to bring Coupang to Japan? Son’s idea appears to be aimed at strengthening the country’s e-commerce business by applying Coupang’s “Rocket Delivery” model in Yahoo Japan Read

If you have ever wanted to drive a train, this game on Nintendo’s Switch is for you. Read

Bridge Over Troubled Water - Paul Simon has sold his entire song catalogue to Sony Music Publishing, joining a string of older musicians cashing in on their life's work. According to Spotify, Paul Simon has 7.3m monthly listeners. Bob Dylan, who sold his 600 song catalogue to UMG for $300m, has 9.6m monthly listeners. Read

Fun things you can do in a Toyota GR Yaris, with Top Gear’s Chris Harris.

📈 MOVERS and SHAKERS 📈

This week, small cap growth was bid as over 70% of the 140 stocks in our Japan Innovation & Disruption (JID) universe rose. The TSE Mothers Index rose +3.4% for the week, rebounding from the -2.6% loss last week.

🚀+24% Raccoon (3031, Mkt Cap $570mn), the E-commerce and payments systems provider, rose on reports that the company was in discussions on expanding EC sales channels into China.

🚀+19%Grace Technology (6541, $790mn), provider of cloud-based manuals, was initiated with a BUY rating by JP Morgan, and a target price of ¥4,500. The stock closed the week at ¥3,085.

🚀+18% Yappli (4168; $560mn), the developer of smartphone apps, had a strong week as small cap growth stocks rebounded. Post-close on Friday, Yappli announced that it had developed for Pietro Corporation, the “Pietro Official App" to help the company expand its customer contact points and boost EC sales.

Thank you for reading and have a great weekend.